blank

Date: 3 June, 2020

Author: Hermann Woithe

When a business is in distress, the owners have important decisions to consider:

- What led to the current situation?

- Can the business be saved?

- What is the best way to save the business?

Companies Act 71 of 2008, as amended

So what do you do if you don’t see a way forward?

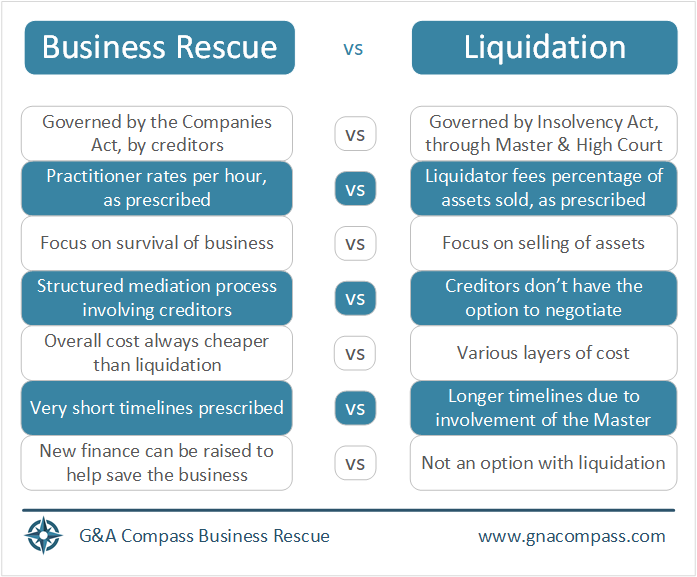

You can opt for liquidation or you can choose business rescue. What is the difference between these two?

Liquidation

Liquidation legislation dates from the 1930’s. (Insolvency Act 24 of 1936). The Act provides for a distressed business to be liquidated through the courts.

- It does not provide for a fair distribution of assets, as it favours the state as a creditor.

- The cost structure associated with the liquidators and auctioneers is structured as a percentage of assets sold.

- There is no incentive to try and rescue the business. The focus is on the sale and distribution of assets only.

- Liquidation involves costly court processes and the Master of the High Court, which means the process is slow, complex, and very expensive.

Business Rescue

Business rescue was introduced in the Companies Act, 71 of 2008.

The intent of it is to give the company a chance to survive, which is not an option under liquidation.

It gives the business rescue practitioner a chance to evaluate whether the business can be saved. If so, the law provides the mechanisms required to pull the business through.

- It places a moratorium on existing debt and gives the practitioner a chance to evaluate the business, without pressure.

- The fee structure for the practitioner’s work is prescribed by law.

- It provides for the acquisition of post-commencement finance to provide the fuel required to pull the business through.

- It provides for a structured, orderly process of creditor participation, with clear guidelines in terms of timelines and obligations of all affected parties.

Conclusion

Business rescue is a more modern way of helping a distressed business than what liquidation is. It gives the business owners more options, it does not involve the courts and it ensures that everyone is treated fairly, as illustrated below.

blank